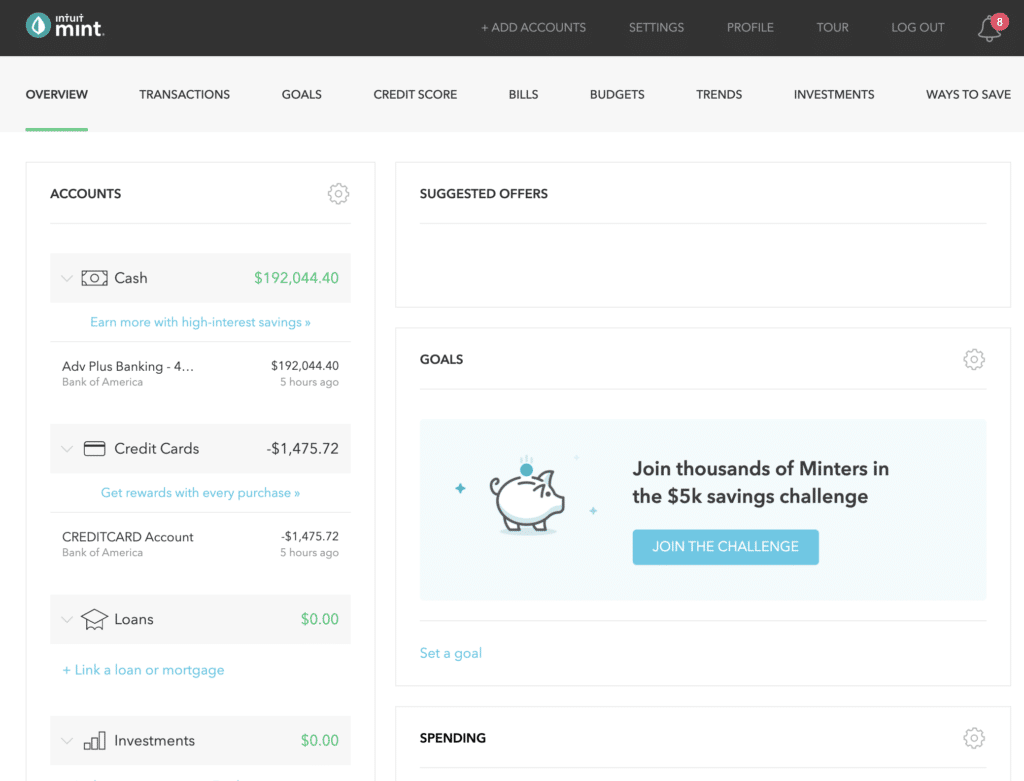

If you’re looking to reduce credit card debt, for example, Mint will spell out explicitly how long it will take to pay it off by just paying the minimum, how much interest you’ll end up paying (shocking), and offer suggestions like using your debit card more to make purchases (in other words, quit charging). Mint allows you to add goals, such as paying off a credit card, saving for retirement, buying a home, or taking a vacation (you can also set your own customized goal). The program can create automatic budgets, based on previous patterns, such as looking at all your grocery spending from last month, and then telling you what you have left to spend this month. For example, rather than just opening up all your accounts at a particular bank to the app, you can choose specific accounts at your bank to allow or block (the other apps simply gain access to all of them automatically). Mint also gives you more fine-grained options when it comes to access to your data. Link them all to Mint and it can send you reminders as well as build a detailed budget. It also includes those handy monthly bills like internet, TV, phone, electricity, and rent. When you sign up, Mint presents you with a straightforward list of accounts to track, from credit cards and bank accounts to loans and insurance.

It’s also the easiest to use for newbies.

Personal capital quicken mint free#

Purchased by Intuit (the folks behind Quicken and TurboTax) a few years ago, Mint is the most complete and mature free financial app available.

0 kommentar(er)

0 kommentar(er)